The blog examines qualitative aspects like MOATs and Porter's Five Forces to gauge a company's competitive edge and future prospects.

Learn

There will always be investment opportunities because people lack patience.

Emérito Quintana

Learn how to identify high-quality companies for long-term investing with key quantitative metrics. Discover indicators like revenue growth, EPS stability, ROIC, debt ratios, reinvestment rate and more, essential for making informed investment decisions. Understand why fundamental business performance outweighs short-term valuation concerns in the pursuit of sustainable returns.

Investing is a business where you can look very silly for a long period of time before you are proven right. In investing, what is comfortable is rarely profitable.

Bill Ackman

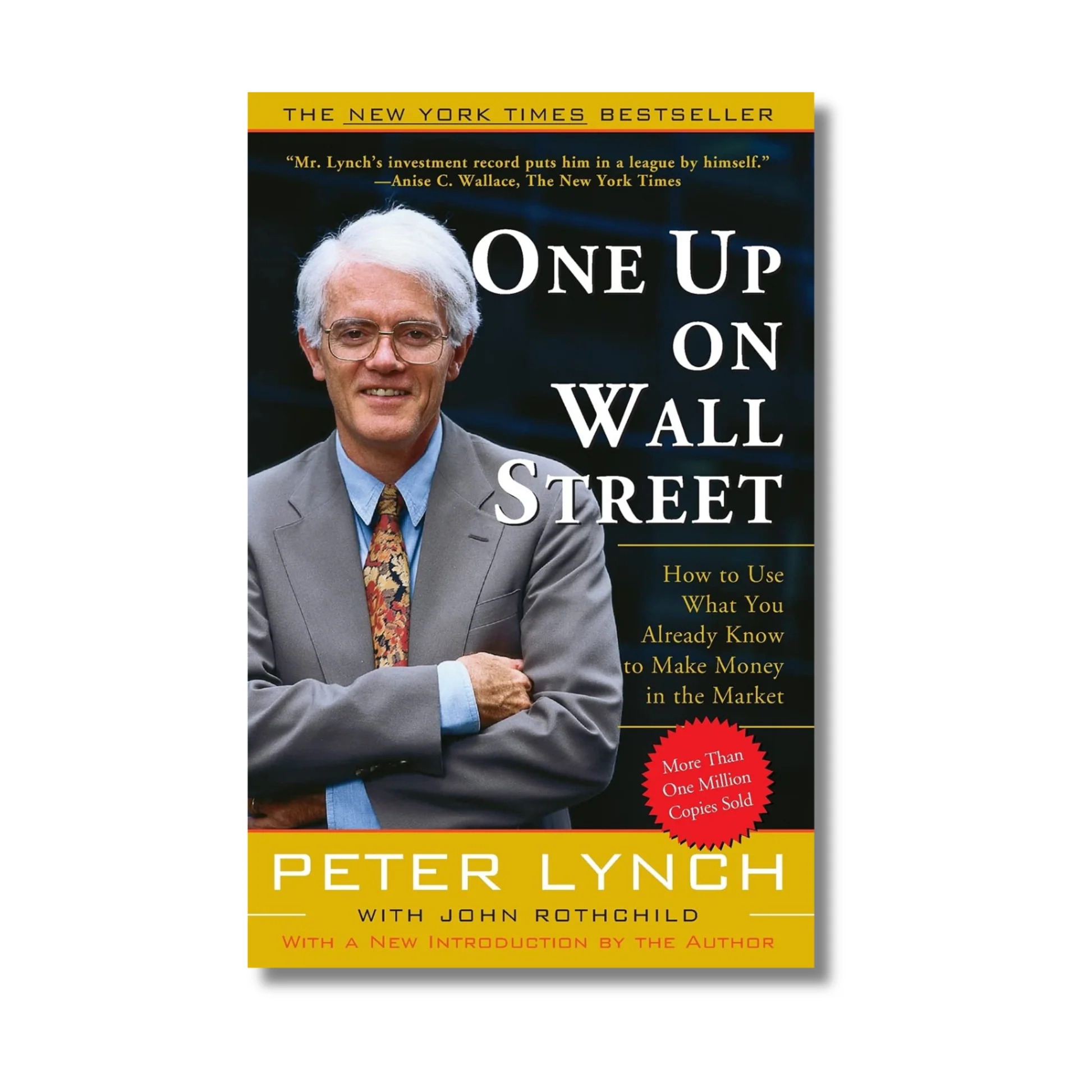

Peter Lynch, who managed the Magellan Fund for 13 years and averaged a 29.2% annual return, explains in this book how retail investors can beat professional managers in a very easy-to-read way.

Show me the incentives, and I'll show you the outcome.

Charlie Munger

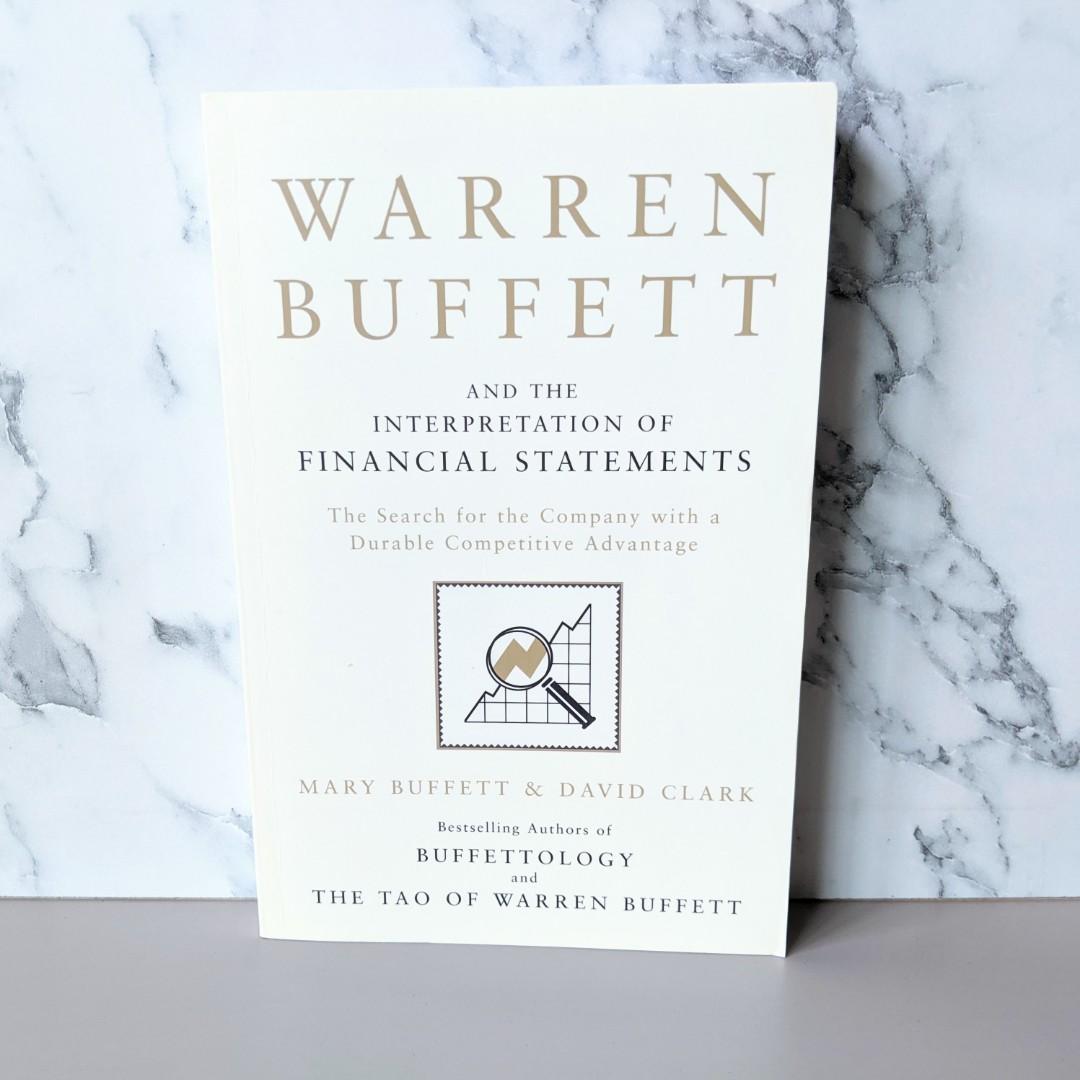

This book teaches the most important aspects to focus on in the three financial statements, according to Warren Buffett, the world's most well-known value investor.

I certainly view volatility as my friend. In short, volatility is on sale because 99+% of the institutions out there are doing their best to avoid it - under the mistaken but Nobel Prize-winning impression that volatility and risk have some relation.

Michael Burry