Acciona, S.A. ($ANA) Investment Thesis

Unlike my previous public thesis, I'll keep this one shorter. I'll provide a list of pros and cons I currently see in Acciona and share my conclusion upfront. After analyzing the company, I find significant negatives outweighing the positives, leading me to believe that Acciona won't outperform popular indexes (e.g., S&P 500, MSCI World) in a 5-year horizon. However, the risk of loss at the current price (106.5€ as of 25/04/24) seems extremely low. As a conclusion, I've opened a small position for monitoring, considering adding to it if management takes returning value to shareholders more seriously.

Before discussing pros and cons, I want to mention that my initial interest in the company stemmed from testing Acciona's e-mobility motorbike platform in Barcelona. I was impressed not only by the app's UX and functionality but also by the electric motorbike itself, which is produced by Silence, a brand under Acciona’s holding.

Now, onto the pros and cons, starting with the former, ranked by importance.

Cons

-

Poor capital allocation:

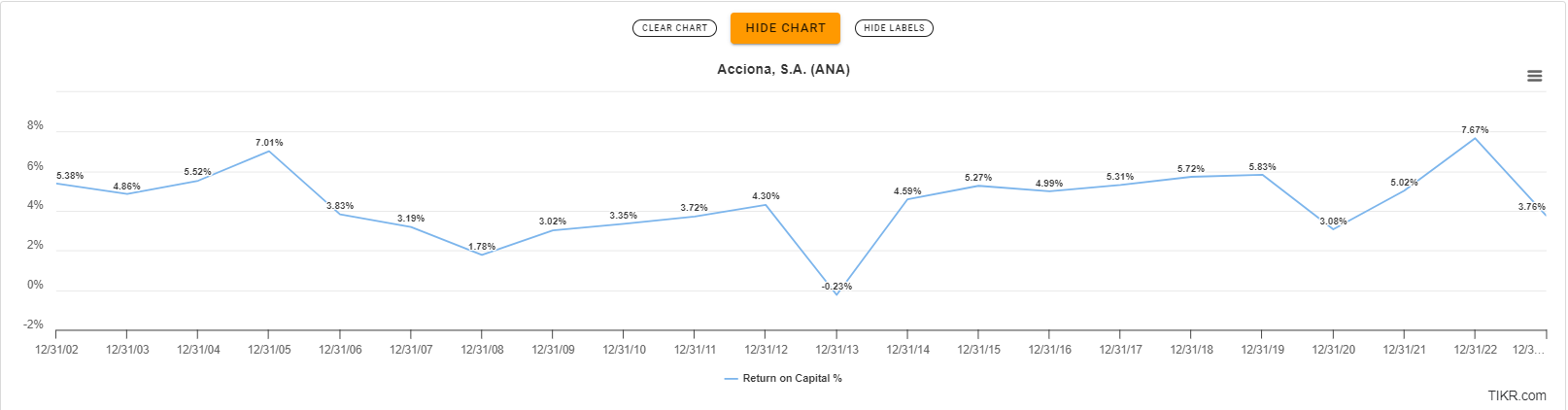

Acciona consistently shows low Return on Invested Capital (ROIC), with the 2023 ROIC at 3.76% and a 20-year average around 4%.

Competitors in Acciona's main sectors (energy and infrastructure) exhibit higher ROICs and margins (refer to Table 2).

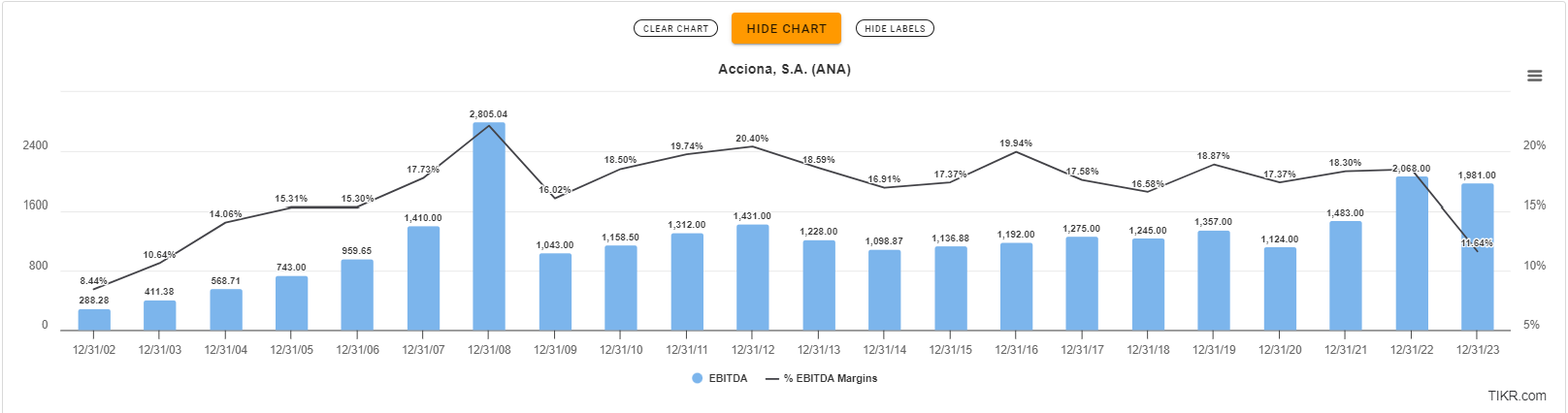

Additionally, Acciona has not yet regained its previous peak EBITDA levels achieved 16 years ago. Why? In the beginning of 2009, Acciona sold a 25% stake in Endesa ($ELE) to Enel for €11.1B. While this helped reduce their debt to more sustainable levels, it worries me they haven't returned to these EBITDA levels 15 years later.

-

Not enough value returned to shareholders:

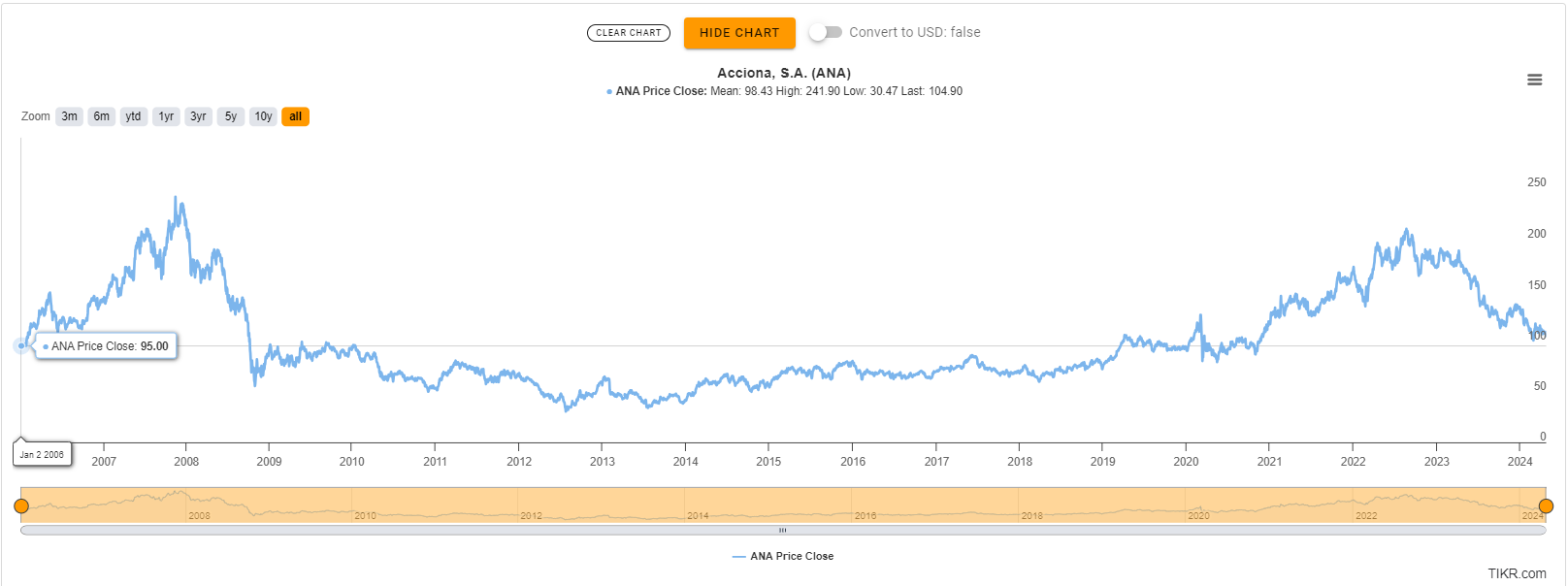

Considering the aforementioned factors and the apparent lack* of emphasis on creating value for shareholders, Acciona's stock has historically performed poorly, with almost flat average performance over nearly 20 years (see image below).

The average annual dividend of around 4% falls short of outperforming the market in terms of yield return. Additionally, the company does not prioritize share buybacks as a means of creating value for shareholders, which is unfortunate. However, there is hope for change. In March 2024, during their Q4 2023 earnings call, Acciona announced their completion of the first share buyback of 1.5% and expressed the possibility of implementing new share buyback programs.

*Comparing Acciona's shareholder communications to those of other holding companies like Brookfield Corporation ($BN) reveals a discrepancy in prioritizing shareholder value creation. While $BN dedicates multiple slides to explaining how they will achieve this purpose, Acciona merely drops a few casual remarks here and there.

-

Somewhat cyclical and lacking pricing power:

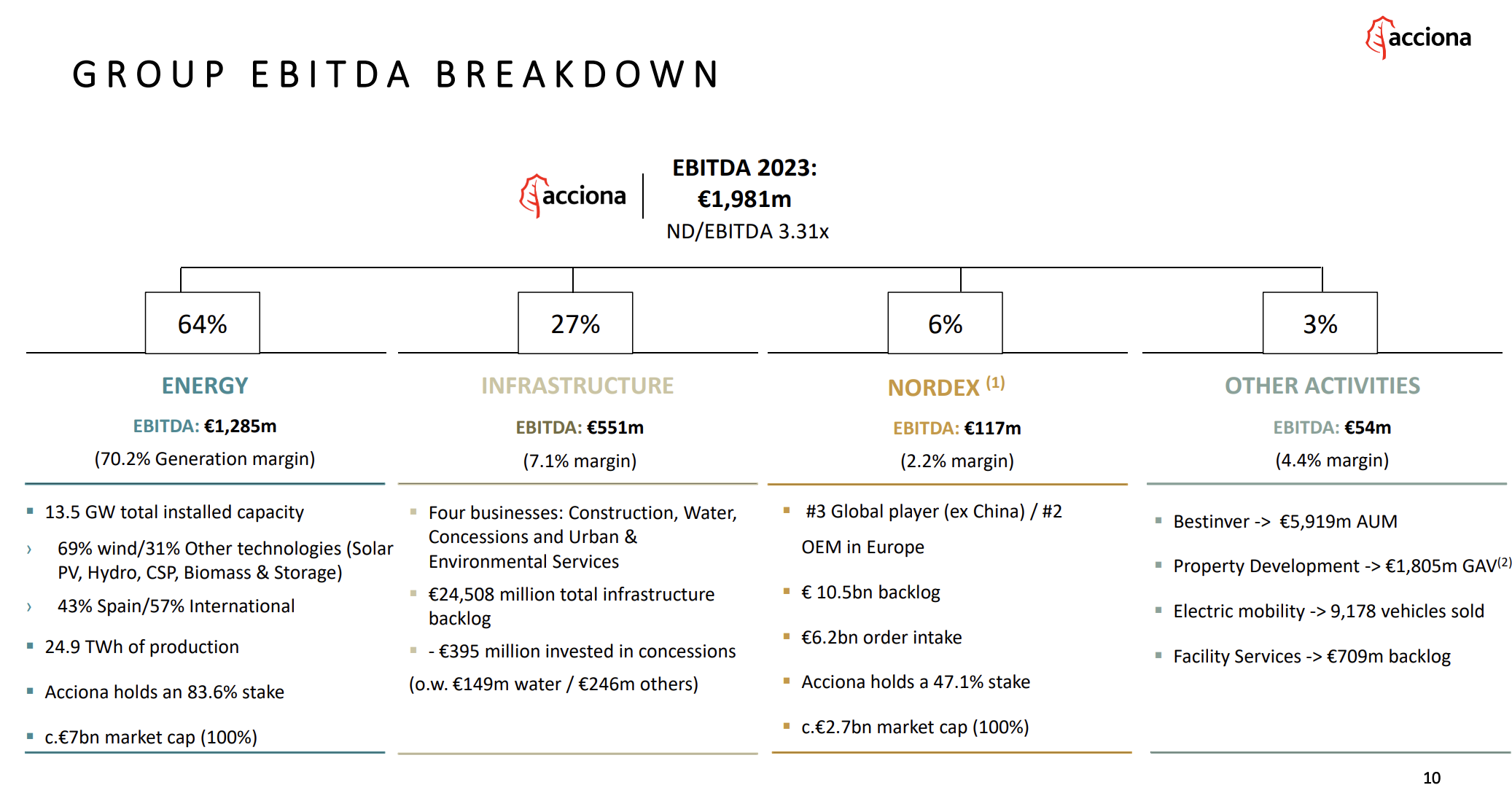

As depicted in the image below, the energy sector contributes 64% of the company's current EBITDA, a sector known for its limited pricing power as electricity prices mainly depend on supply and demand, influenced by macroeconomic conditions and weather patterns (especially for renewables). Additionally, 27% of EBITDA comes from the infrastructure business, which is also sensitive to macroeconomic conditions. Given the current economic climate, particularly the heightened likelihood of stagflation in Europe, I am uneasy. The cyclical nature, as displayed in Image 2, suggests a lack of consistent performance, often indicative of a company lacking meaningful competitive advantage.

-

Poor capital allocation:

I haven’t found any mutual or hedge funds with significant positions in the company, which, to me, is concerning.

Pros

-

Valuation discount:

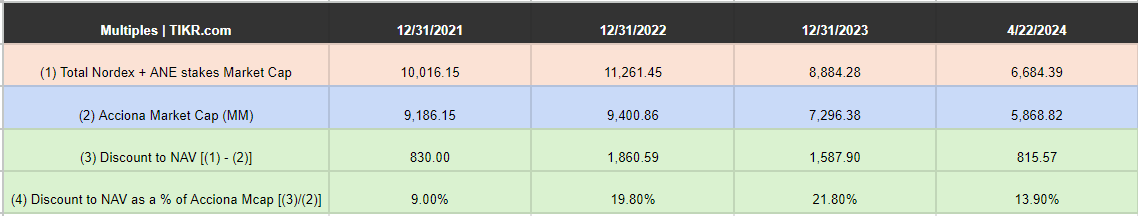

As illustrated in the preceding image, Acciona holds an 83.6% stake in Acciona Energía ($ANE) and a 47.1% stake in Nordex ($NDX1). Only by summing the market capitalization of these two stakes, we observe that Acciona's current market capitalization reflects a discount of approximately 14%, which, surprisingly, is not the largest discount recorded in the past four years.

And this valuation does not even account for the rest of the businesses, which collectively generate 30% of Acciona’s current EBITDA. By valuing this remaining conglomerate of businesses at a very conservative EV/EBITDA multiple of 5 times (refer to Table 2 for multiples of other infrastructure companies as of 26/04/24), the valuation discount of Acciona’s current stock price compared to its fair intrinsic value amounts to approximately 60%.

Ticker Name NTM EV/Revenue NTM EV/EBITDA LTM ROIC 2023 EBITDA Margin 2023 net debt/EBITDA 2023 Dividend Yield FER Ferrovial SE 3.81x 25.99x 3.55% 11.64% 6.48x - DG Vinci SA 1.22x 7.03x 11.34% 17.38% 1.58x 3.96% EN Bouygues SA 0.43x 5.13x 6.61% 8.11% 1.94x 5.57% ACM AECOM 0.90x 13.02x 15.08% 6.70% 1.38x 0.78% FGR Eiffage SA 0.96x 5.83x 9.57% 17.47% 2.92x 4.23% FCC Fomento de Construcciones y Contratas, S.A. 1.16x 6.74x 8.08% 16.95% 2.30x - IBE Iberdrola 2.75x 8.66X 7.41% 29.22% 3.63x 4.63% Table 2: important financial metrics of other infrastructure companies.

-

Tailwinds:

According to Acciona's 2024 shareholder presentation, the global push for decarbonization (i.e., electrification) and the integration of the Sustainable Development Goals listed in the 2030 Agenda are driving the largest reallocation of capital in history. This includes almost universal Net Zero commitments, unprecedented policy support, and a stable, predictable demand for infrastructure assets from institutional investors. These factors are creating unparalleled opportunities for SMART (Sustainable, Mitigating, Adaptative, Resilient, Transformative) infrastructure providers like Acciona.

-

Aligned and trustworthy management:

Approximately 55% of Acciona, S.A. is owned by WIT Europese Investering B.V. and Tussen de Grachten BV, which are the family holdings of Acciona CEO Jose Manuel Entrecanales Domecq, son of Acciona founder Jose Maria Entrecanales, and Juan Ignacio Entrecanales, the current vice president of the company.

As an example of successfully meeting public estimates, in 2020, with 10GW capacity already installed, the company announced plans to install 1GW each year to reach 15GW installed by 2025. They are on track to achieve this goal, having ended 2023 with 13.5 GW of installed capacity.

-

Future outlook:

The company anticipates a mid-to-high single-digit EBITDA compound annual growth rate (CAGR) for the period 2024-2028.

Contact If you have any doubts or would like to exchange thoughts, please feel free to contact me. I will respond as soon as possible.

Send email